Global Financial Safety Net Tracker (GFSN tracker) will provide a real-time tracking of the GFSN that currently includes a large number of increasingly big Regional Financial Agreement (RFAs) in all continents, bilateral currency swaps between central banks, crisis lending by multilateral development banks, bilateral short-term loans, repo agreements, and hedging instruments by central banks. Effectively, the GFSN tracker will identify all relevant sources of liquidity for the most vulnerable countries.

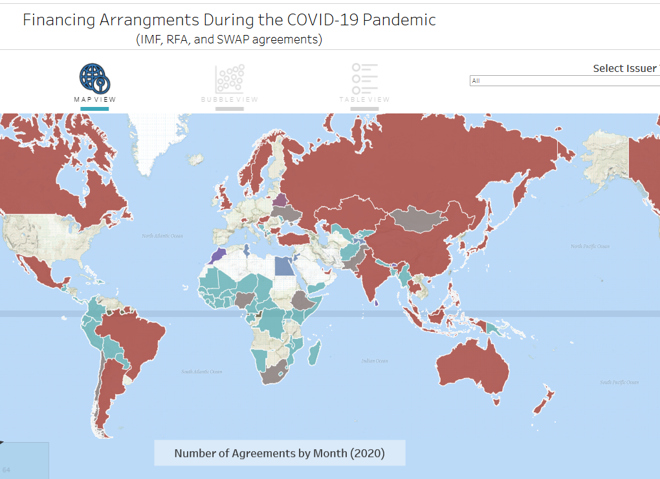

In this paper, we summarize the findings of the Freie Universität Berlin / Boston University / UNCTAD Global Financial Safety Net (GFSN) tracker on crisis finance since the onset of the COVID-19 pandemic. The GFSN is commonly known as the set of institutions on the global, regional and bilateral level that provide balance of payments finance to countries in temporary financial distress. We show that, when grouping the countries in different income classes, provision of liquidity is highly unequal.

During the COVID-19 crisis, swaps between central banks played a major role in providing short term liquidity – accounting for almost 95 per cent of the value of transactions provided by the Global Financial Safety Net (GFSN). In the discussion below, we set out a description of these swaps, the role they play and how they came to be so important.

The world economy has gone into a freefall due to the COVID-19 pandemic. At the same time, policy-makers have a broader range of

institutions to draw on for international liquidity support than before the global financial crisis 2008/09. Since the 2008/09 crisis, the

so-called Global Financial Safety Net (GFSN) of institutions for short-term crisis finance has evolved into an uncoordinated patchwork

of global, regional, and bi-lateral sources of support that lacks the resources to adequately prevent and mitigate the kinds of financial

instability we are now witnessing.

Policy-oriented analysis for countries to better understand global and regional trends in the light of the COVID-19 pandemic.