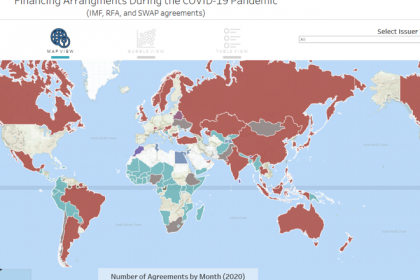

Global Financial Safety Net Tracker (GFSN tracker)

Global Financial Safety Net Tracker (GFSN tracker) will provide a real-time tracking of the GFSN that currently includes a large number of increasingly big Regional Financial Agreement (RFAs) in all continents, bilateral currency swaps between central banks, crisis lending by multilateral development banks, bilateral short-term loans, repo agreements, and hedging instruments by central banks. Effectively, the GFSN tracker will identify all relevant sources of liquidity for the most vulnerable countries.